Retail

Minimize exposure to internal and external fraud threats

Prevent retail fraud and investigate theft with robust retail fraud software

Bolster retail fraud prevention and grow your business

50%

improvement in identity verification efficiency

25%

reduction in institutional overhead

85%

of retail customers highly recommend our solutions

Safeguard your customers, company, and employees

Efficiently onboard low-risk, legitimate customers and merchant businesses

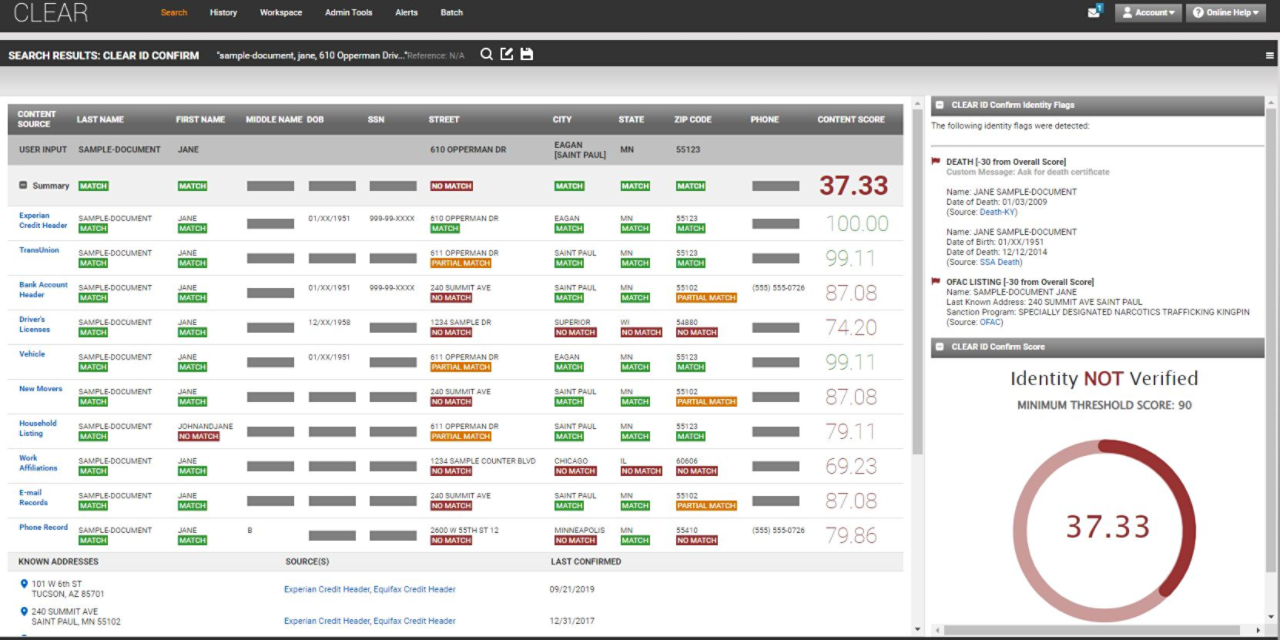

Perform identity verification during online account creation or in-person credit applications. We provide identity intelligence, document authentication, and public records validation for efficient customer and merchant onboarding.

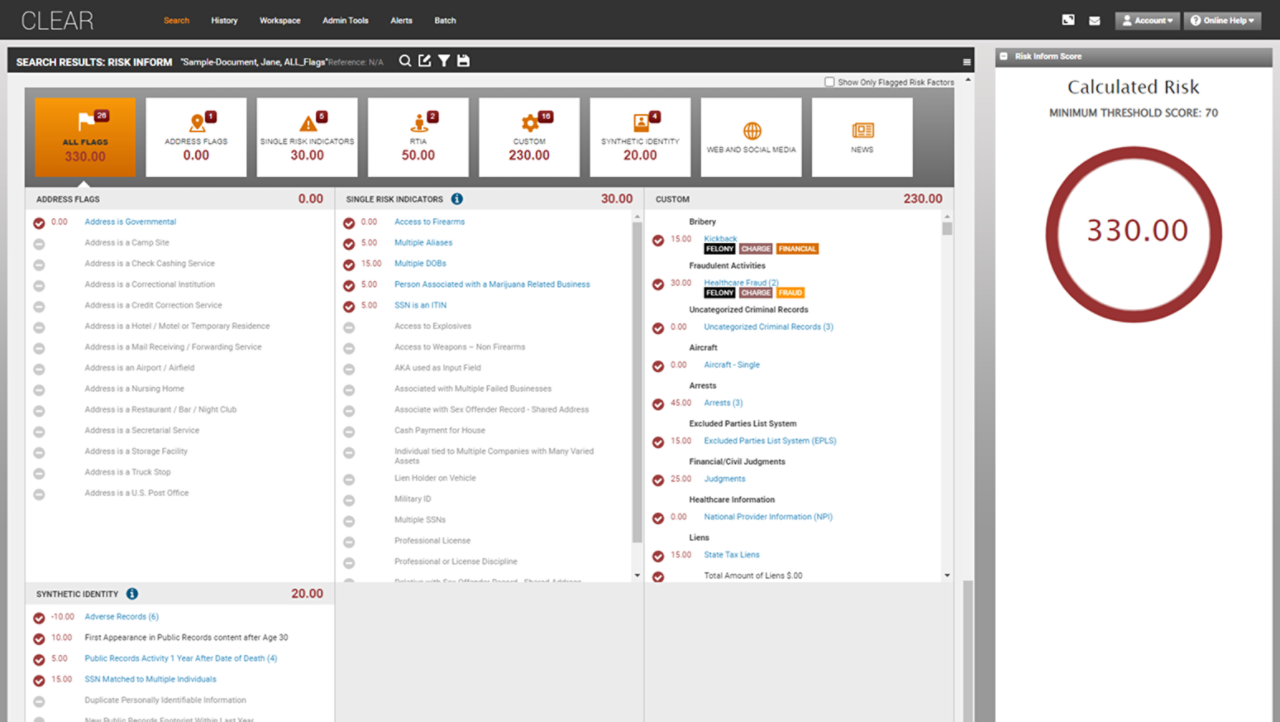

Quickly assess the trustworthiness of customers and business partners

Know exactly when enhanced due diligence is needed — without guesswork. Automated risk scoring helps you instantly spot red flags, including synthetic identities, multiple aliases, criminal histories, or fraud connections. Our easy-to-read risk score removes subjectivity and human error, and customizable parameters let you set thresholds that match your business needs.

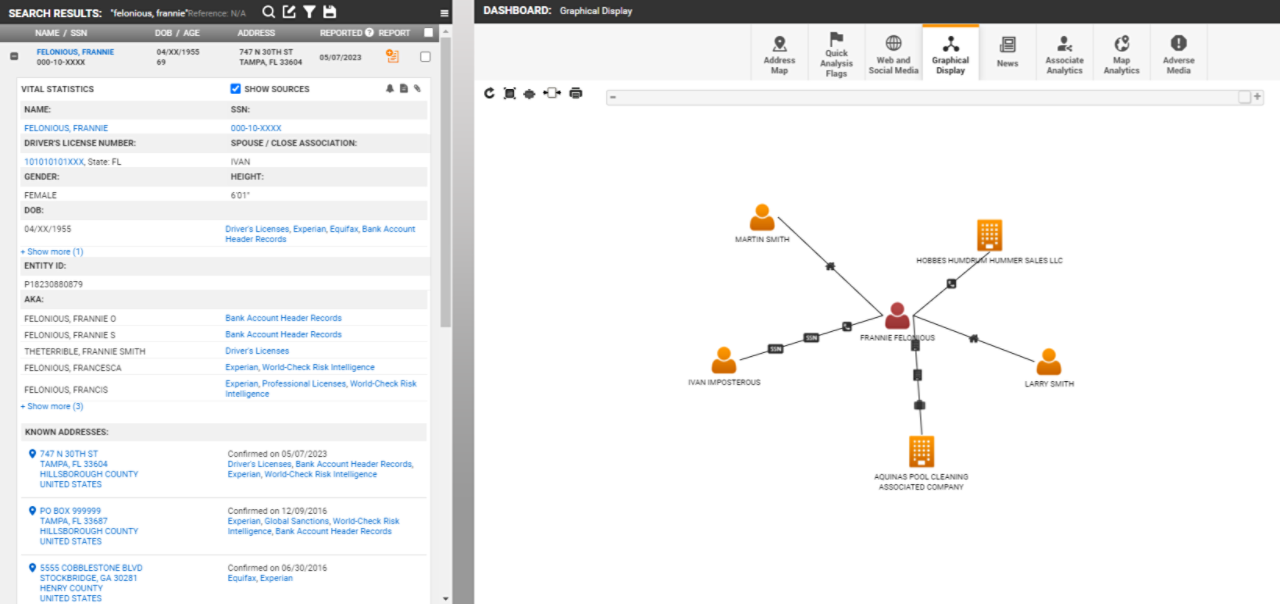

Effectively conduct investigations if fraud and theft slip through the cracks

Mitigate theft, fraud, and organized retail crime with our powerful investigative tools, including robust public and proprietary records, risk analysis, and license plate data. Easily generate and download reports for law enforcement from our desktop solution.

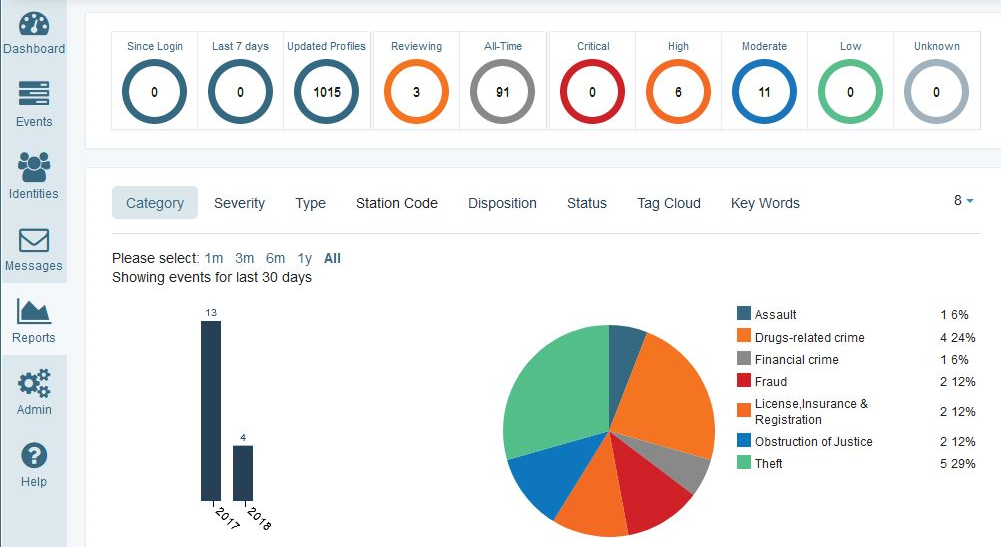

Detect, reduce, and investigate insider risk within your workforce

Continuously perform know-your-employee monitoring with automatic scans of public data sources, effectively triggering real-time, tailored alerts for your security, investigations, or risk management departments to promptly review.

Access the tools you need to solve your challenges

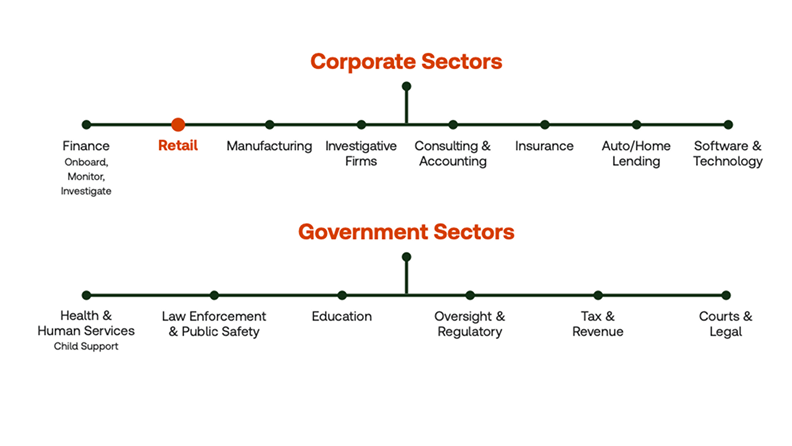

Thomson Reuters Risk & Fraud Solutions

Leverage numerous capabilities to assist your retail organization with onboarding customers and merchants, and monitoring and investigating for fraud, including robust identity verification, configurable risk scoring assessment, workforce risk evaluation, a comprehensive database of license plate recognition data, automated public records alerts, and U.S. consumer and commercial public records.

Thomson Reuters Risk & Fraud solutions

Risk mitigation and fraud prevention designed for the retail and e-commerce marketplace

Our risk and fraud solutions for retail and e-commerce can help you gain a more holistic view of the risks, empowering your teams to investigate and resolve incidents efficiently. Ensure minimal disruption and swift recovery to improve your customer loyalty. Download the brochure for a complete picture of how our solutions can improve your workflow.

“CLEAR has been able to reduce hours to complete an investigation, reduce human error, reduce risk, and improve the effectiveness of our investigations.”

Renee Dossey-Tackett,

Compliance Officer, AMR Corporation

Ready to get started?

Fill out the form to learn how Thomson Reuters Risk & Fraud Solutions can help protect your customers, company, and employees.

Thomson Reuters is not a consumer reporting agency and none of its services or the data contained therein constitute a “consumer report” as such term is defined in the Federal Fair Credit Reporting Act (FCRA), 15 U.S.C. sec. 1681 et seq. The data provided to you may not be used as a factor in consumer debt collection decisioning; establishing a consumer’s eligibility for credit, insurance, employment, government benefits, or housing; or for any other purpose authorized under the FCRA. By accessing one of our services, you agree not to use the service or data for any purpose authorized under the FCRA or in relation to taking an adverse action relating to a consumer application.