Leveraging AI in risk management is critical to effectively protect your organization and maintain compliance in today's complex landscape.

It’s often the risk you don’t see—because you don’t see it—that causes the most damage. It might new legal or tax regulations that require organizations to be compliant. Maybe a customer’s name has been quietly added to a country sanctions list. Or perhaps an AI-generated phishing email has secretly inserted a bit of malware into the organization’s IT system.

With businesses and government agencies needing to detect and mitigate increasingly numerous and complex risks with fewer resources, risk and fraud professionals have started incorporating artificial intelligence (AI) into their risk management strategies. Here’s what these professionals should know about AI in risk management that could have a real-world potential impact.

Jump to ↓

Understanding AI in risk management

How to use AI in risk management

Best practices for AI in risk management

Understanding AI in risk management

AI in risk management refers to the application of AI technologies—including machine learning, natural language processing, and predictive analytics—to identify, assess, and mitigate potential risks across an organization. Because AI systems can analyze vast amounts of data, it can uncover potential problems that traditional risk management approaches might miss and improve decision-making processes. In addition, with new AI models, it can continuously monitor transactions and operational processes to provide real-time risk insights and automated alerts.

By leveraging AI’s benefits, businesses can significantly enhance their risk prediction accuracy, identifying threats before they become costly crises. This proactive approach allows organizations to make faster decisions, allocate appropriate resources, and maintain regulatory compliance.

However, AI itself introduces risks of its own. As a digital technology, AI systems have intricated “supply chains” of code, which may make them vulnerable to threat actors seeking to disrupt their algorithms and large language models (LLMs). And since AI can process so much data, there’s the risk that sensitive information may tempt determined cyber-criminals. But by using AI’s fraud detection capabilities, risk and fraud professionals can fight fire with fire.

How to use AI in risk management

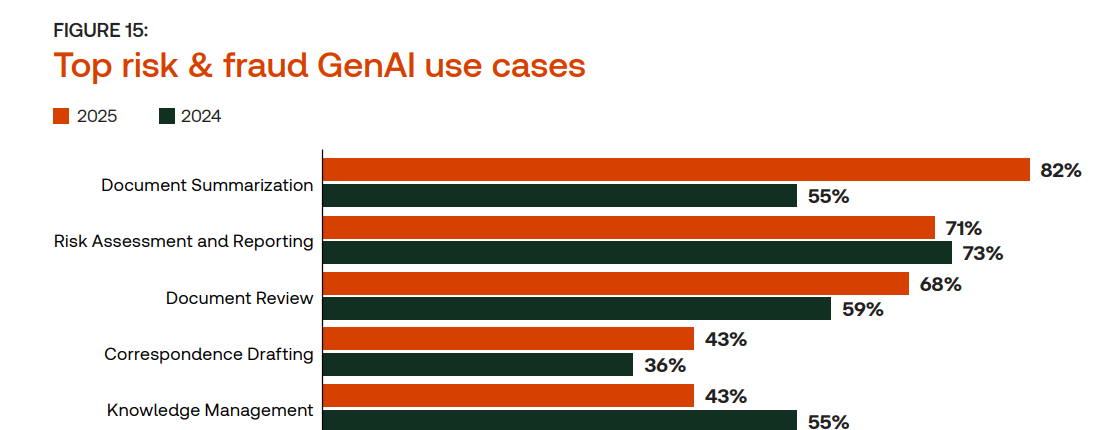

The Thomson Reuters Institute’s 2025 Generative AI in Professional Services Report surveys how risk and fraud professionals are currently using AI to optimize their workflows. Here we’ll look at the top three use cases that risk and fraud professionals cited in the report. By reducing the time needed for mundane (but necessary) tasks like these, AI lets these professionals focus on higher-level due diligence, risk management, and strategic planning. This points to two of the most powerful benefits of AI, saving time and boosting productivity, which thus allow professionals to do their best work.

Document summarization

Risk and fraud professionals must help manage their organization’s compliance with various government regulations, whether local, federal, or international. As those professionals well know, this work presents several challenges. For one thing, regulations are continually revised, and the changes aren’t always clearly and concisely stated or delineated.

An AI tool can review regulatory documents and updates, then summarize the changes and other important details in plain language. Compliance teams can respond and help keep their organization compliant—thus sidestepping the risks of large fines, loss of customers, and reputational damage.

Risk assessment and reporting

An effective risk assessment process identifies, analyzes, and rigorously evaluates any risks that might arise from a particular organizational activity or project. That allows the business or agency to prepare mitigation plans.

Such assessments must be thorough—and they often need to be done quickly. By rapidly reviewing and analyzing massive amounts of data, an AI tool can reveal potential fraud risks, including ones that human analysts might overlook. This gives the organization the precious time it needs to prevent these risks from disrupting operations.

Document review

This AI benefit is related to regulatory document summarization, but it’s more extensive. Risk and fraud professionals need to review a variety of documentation–which can include financial statements, internal communications, and monitoring data on high-risk customers and transactions–for any red flags. AI-powered document review can deliver reliable summaries and actionable insights on many types of risk.

Best practices for AI in risk management

For effective AI risk management processes, organizations require a framework for safe and responsible AI usage. Risk and fraud teams can establish metrics and best practices that address risks involving data privacy, algorithm bias, the reliability of AI outputs, and cybersecurity.

Modelling the NIST Framework

The National Institute of Standards and Technology has developed industry standards called the NIST AI Risk Management Framework (NIST AI RMF) for identifying, assessing, and mitigating AI-related risks throughout an organization. Businesses can use the NIST Framework as a benchmark to identify areas requiring improvement.

Using AI ethically and responsibly

Navigating AI’s ethical and regulatory issues represents a set of major risk management challenges. One best practice for managing and mitigating these risks is an internal AI governance committee. This group would create and enforce clear policies regarding transparency, privacy, and the overall responsible use of AI platforms. It can also boost AI “explainability”—that is, it can communicate to users in clear language AI’s powerful benefits and potential risks.

In addition, organizations can implement robust testing protocols to detect and mitigate algorithmic bias. One such protocol is ongoing monitoring of AI outputs across different organizational departments.

Staying current on AI advancements

Technology is always evolving, and that’s especially true of AI. An organization should consider putting in place a dedicated intelligence function or sign up to AI newsletters that keeps close tabs on industry news, regulatory developments, and AI advancements and vulnerabilities. This can help the business or agency anticipate potential risks associated with AI use. A regular training program for staff involved in AI risk management can ensure that they’re current on best practices and emerging threats.

Another crucial best practice is engaging with appropriate technological tools. Based on the report, 95% of all industry professionals surveyed in the report expect GenAI to become a central part of their organization’s daily workflow within the next five years, but many organizations are still not prepared for the full transition.

- AI Newsletter: Get industry-leading AI insights delivered monthly to your inbox.

- Risk & Fraud Solutions: Risk is ever-evolving but with AI-enhanced technology for risk management, you can anticipate tomorrow’s threats and evolve faster.

- By combining generative AI with CLEAR data, you can streamline investigations and due diligence with our risk analysis summary feature.

- Data visualization and delivery, which unifies risk and data analytics, reporting, and real-time fraud alerts in a user-friendly format that can benefit several industries.