Today’s economy remains unpredictable. While some large enterprises continue to face challenges and implement layoffs, many others are experiencing rapid growth and expanding their operations. Both struggling and thriving companies are actively seeking new vendors to meet rising demand, secure reliable service providers, and diversify their supply chains—often pursuing all three strategies at once.

Whether your company is growing or facing challenges, it’s important to recognize the value of identity verification. Growth brings exciting opportunities, but it also introduces new risks, especially when resources are limited. As an onboarding officer, risk manager, property manager, fraud investigator, or anyone responsible for customer due diligence (CDD) or know-your-customer (KYC) programs (regardless of your company’s specific terminology), you and your team play a critical role in managing these risks and ensuring safe, compliant operations.

That continues to be a priority for businesses internationally. It’s important to ensure new customers, vendors, and other associate parties aren’t putting your company at risk financially or reputationally. There are regulations and requirements that must be met that provide a layer of protection. You can enhance your protection through your onboarding process with thorough identity verification of the individuals and entities currently (or potentially) doing business with your organization.

A big reason why you worry: The costs of not knowing your customer or vendor can be very high.

Why you mission is critical for identity verification

Regulators continue to impose hefty fines, sometimes reaching millions of dollars, on companies that fail to meet compliance standards. Beyond these direct financial penalties, you also risk damaging your company’s reputation if you inadvertently work with customers or vendors linked to illicit activities like embezzlement, money laundering, human trafficking, or terrorism financing. In today’s hyper-connected world, news of these associations spreads quickly, eroding trust among clients, partners, and the public. That’s why it is critical for identity verification to be part of your organizational mission.

You also face operational risks when customers or vendors can’t (or won’t) pay their bills or deliver on contracts. While these situations may not draw regulatory scrutiny, they can still hurt your company’s bottom line and disrupt performance. These outcomes are something neither investors nor executives want to see.

Although most KYC and CDD regulations target the financial services sector, regulators are increasingly scrutinizing other industries as well. Criminals often look for new avenues to exploit, and no reputable business wants to discover that their products or services have enabled illegal activities. Staying vigilant and proactive with due diligence is important and protects your company, your reputation, and your stakeholders in today’s evolving risk landscape.

The key to saving time and adding business

Properly conducted KYC due diligence is absolutely crucial. It also is massively time-consuming. How can you and your team meet stringent guidelines for customer and vendor identity verification without bringing the onboarding process to a costly crawl? Especially when resources for such due diligence – including finding qualified hires – aren’t always available when they’re needed?

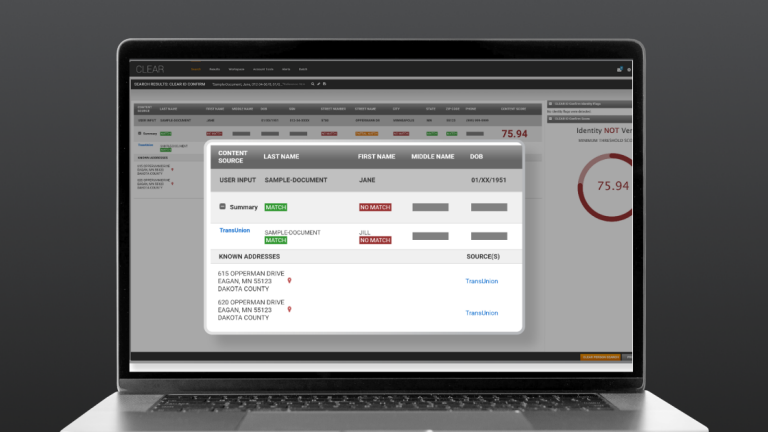

A digital tool designed to help manage this complex, essential work and do so efficiently is Thomson Reuters CLEAR ID Confirm. The foundation of this solution is Thomson Reuters CLEAR, a high-powered digital gatherer of public records. CLEAR ID Confirm rapidly sorts through continuously updated public and proprietary data, including live credit header data, daily updated phone files, corporate filings, and federal employee ID numbers (FEIN), to verify that these parties are indeed who they say they are — and that they’re not involved in activities that could cost your company in terms of embezzlement, fines, or reputation.

CLEAR ID Confirm also pores through passport MRZ verifications, death records, and sanctions listed with the U.S. Office of Foreign Assets Control. In addition, it can discover whether there are redundant Social Security numbers or multiple business entities using the same FEIN. It also gives your organization access to identification verification data for international and non-U.S. subjects across 40 countries. And it allows you and your team to uncover synthetic identities and easily authenticate identity documents. What’s more, it identifies the sources of the ID information it provides so that you can be confident that your due diligence investigations are being adequately supported.

CLEAR ID Confirm’s capabilities can allow your organization to quickly onboard clients, vendors, and other third parties with which it is doing (or wishes to do) business. At the same time, it can help give you confidence that your company isn’t being exposed to risk by inadvertently providing a financial haven for fraudsters or criminals. And it can help you keep your enterprise growing and prospering.

Learn more about how to protect your business from risk exposure though rigorous identity verification.

Thomson Reuters is not a consumer reporting agency and none of its services or the data contained therein constitute a ‘consumer report’ as such term is defined in the Federal Fair Credit Reporting Act (FCRA), 15 U.S.C. sec. 1681 et seq. The data provided to you may not be used as a factor in consumer debt collection decisioning, establishing a consumer’s eligibility for credit, insurance, employment, government benefits, or housing, or for any other purpose authorized under the FCRA. By accessing one of our services, you agree not to use the service or data for any purpose authorized under the FCRA or in relation to taking an adverse action relating to a consumer application.