Jump to ↓

| Factors that affect data accuracy |

| The importance of accuracy in AML and CDD procedures |

| Prioritize accuracy over technology |

Accuracy and transparency are the cornerstones of data-driven decision-making, as any small error can result in an entirely inaccurate outcome that pollutes an entire dataset. As the popular data science acronym GIGO tells us: garbage in, garbage out. If you use data that you can’t guarantee is accurate, you’re liable to end up with information that results in bad decision-making. The quality of an organization’s decision-making processes is inextricably linked to the quality of its data.

Transparency regarding the source of the data is equally important, as, without clarity in this respect, you must rely on the trustworthiness of the data provider. Your organization may have a well-established relationship with a reliable data provider, but you can’t back up the validity of your results without transparency. When considering your options regarding third-party data provision, always look for a provider that puts accuracy and transparency first.

|

Factors that affect data accuracy

Research from Gartner reveals bad data costs companies an estimated 15% of their revenue, with the average financial impact to a company costing $9.7 million per year. Bad data can put your organization at risk of losses from fraud and penalties as the result of inaccurate reporting. Beyond the base financial cost, the reputational damage can be even more costly to a company should it become embroiled in a high-profile case.

The following factors are the most common causes of inaccuracy in data reporting:

Timeliness

Data decay is a term used to describe how information loses relevance over time. The more recent the data, the more accurate it’s likely to be. Leading data companies will always use the most up-to-date data.

Accuracy

There are several common causes of inaccuracy in data reporting, including human error during manual entry, mathematical errors, or non-standardized data sets. Organizations should enact data governance policies to ensure they adhere to standards.

Consistency

Lack of consistency hampers every part of the AML and CCD process. When the available data cannot be corroborated, it renders what you have nearly useless. When multiple departments within an organization access a singular data source, consistently having key data points like personal identifiable information or beneficial ownership information is essential.

Relevance

Non-relevant information can unnecessarily complicate a dataset, with the potential to decrease the overall accuracy. It’s best practice to only collect metrics that are directly relevant to the research at hand.

Validity

Too many organizations these days focus on speed of delivery and cut corners when it comes to data validation. To avoid inaccuracies, it’s vital to take the time to validate the source of data. This is where data transparency is critical or validation can be a slow and difficult process.

Completeness

Statistical models built using incomplete data are unlikely to provide accurate results. If you use data to assess risk or evaluate probability, it will be impossible to achieve 100% accuracy with an incomplete dataset.

The importance of accuracy in AML and CDD procedures

When conducting customer due diligence (CDD) to meet anti-money laundering (AML) procedures, accuracy and transparency are critical. The new regulations regarding AML reporting apply to any business dealing in financial services and have serious consequences for those that don’t comply.

A lack of accurate data is no excuse for failure to comply with AML reporting requirements, so you can’t take any chances with unreliable sources. Financial services providers are required to enact strict CDD processes and, when necessary, enhanced due diligence (EDD) on high-risk customers.

Besides the potential for money laundering, the provision of financial services also puts your organization at risk of terrorism financing. Combating the financing of terrorism (CFT) is another part of CDD that requires highly accurate and reliable data to make effective risk assessments.

Prioritize accuracy over technology cords

The Thomson Reuters anti-money laundering insights survey collected information from a range of financial services providers who need to meet compliance requirements. The survey revealed the following statistics regarding data collection for CDD procedures:

- Almost 50% of businesses use some form of technology to manage their AML and CFT programs

- Only one in five businesses who gather AML and CDD information via a third party feel “extremely satisfied” with the comprehensiveness of the data they receive.

- Data accuracy, reputation, and well-structured data were cited as the most important features that financial organizations look for when choosing a third-party provider for AML and CDD processes.

These statistics highlight the need for better accuracy and transparency in data reporting. Rather than simply adopting the latest regulation technology to streamline AML processes, financial organizations need to focus on data providers that prioritize accuracy as a means of reducing risk exposure.

Highly accurate and transparent data technology

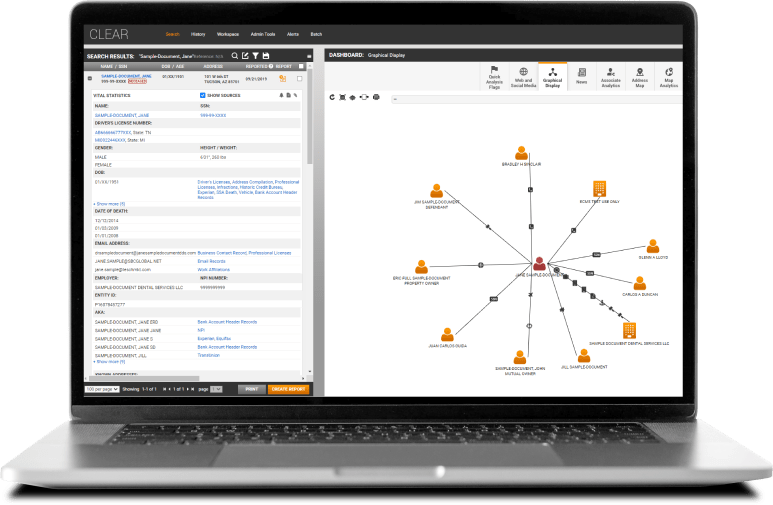

Thomson Reuters CLEAR® is a powerful data analytics tool that uses billions of data points and the latest public records technology to provide data that is both highly accurate and fully transparent. Accessed via a user-friendly interface with intuitive navigation and powerful filtering tools, you can quickly search across thousands of data sets and locate the precise information necessary to identify customers and pinpoint high-risk entities.

|

Thomson Reuters is not a consumer reporting agency and none of its services or the data contained therein constitute a ‘consumer report’ as such term is defined in the Federal Fair Credit Reporting Act (FCRA), 15 U.S.C. sec. 1681 et seq. The data provided to you may not be used as a factor in consumer debt collection decisioning, establishing a consumer’s eligibility for credit, insurance, employment, government benefits, or housing, or for any other purpose authorized under the FCRA. By accessing one of our services, you agree not to use the service or data for any purpose authorized under the FCRA or in relation to taking an adverse action relating to a consumer application.