Fraud prevention tool

Detect, prevent, and mitigate fraud in your program with ID Risk Analytics

Receive a holistic, prioritized view of identity-based risk within your agency’s program population

Reduce improper payments and protect program integrity

Generate custom reports with transparent analytics

Gain clarity on your investigation's next steps with the Special Investigation Unit. This customized report is made up of more than 40 behavioral analytic algorithms, with risk scoring and verified identity data, to help your team prioritize leads.

Request free demo

Have questions?

Contact a representative

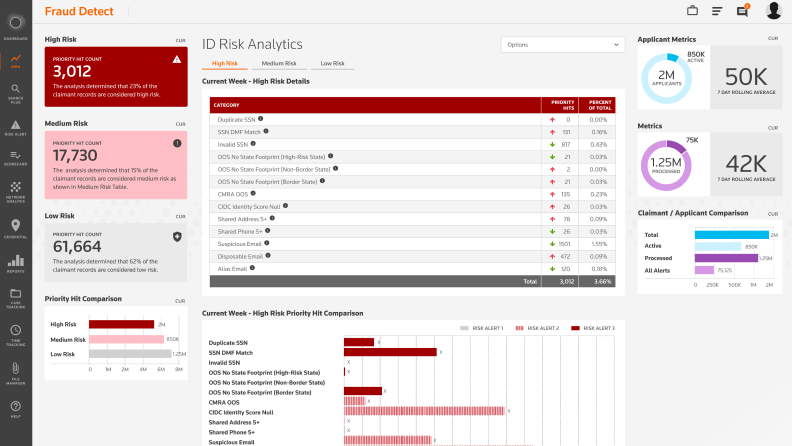

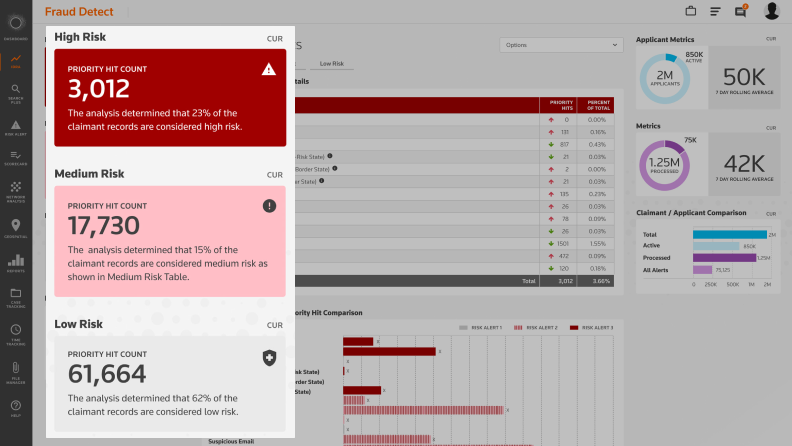

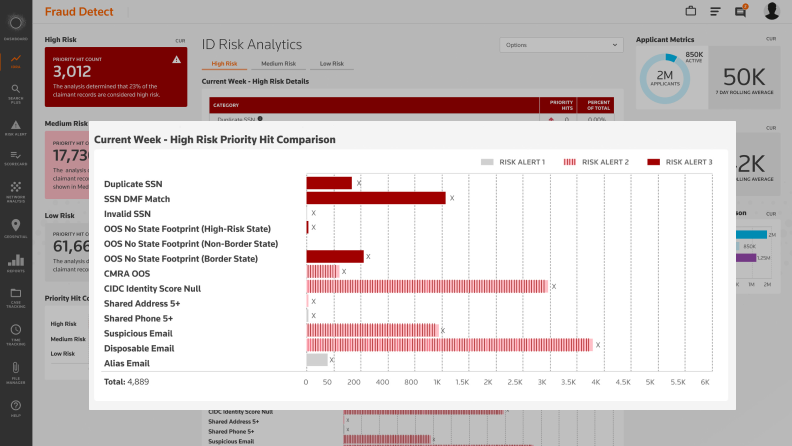

List risks by priority with categorized risk prevention

Color-categorized severity levels will help you prioritize claimants so you can focus on the subjects with the most risk.

Request free demo

Have questions?

Contact a representative

Quickly and clearly identify your agency's next steps

See where each record falls within risk categories, as well as the total benefits paid to high, medium, and low-risk claimants. The easy-to-understand narrative outlines your agency’s needs and potential risks.

Request free demo

Have questions?

Contact a representative

The value of ID Risk Analytics

Internal subject data such as application metrics and claim metrics

Shared analytics such as addresses, phone numbers, and incarceration data

Customized risk alerts to detect patterns and anomalies

Identity validation and confidence scoring via CLEAR ID Confirm

Questions about ID Risk Analytics? We're here to support you.

972-998-0883

Call us or submit your email and a sales representative will contact you within one business day.

Contact us

ID Risk Analytics support

Get answers to your ID Risk Analytics questions

Access to these tools is limited to authorized, vetted professionals.

Thomson Reuters is not a consumer reporting agency and none of its services or the data contained therein constitute a “consumer report” as such term is defined in the Federal Fair Credit Reporting Act (FCRA), 15 U.S.C. sec. 1681 et seq. The data provided to you may not be used as a factor in consumer debt collection decisioning; establishing a consumer’s eligibility for credit, insurance, employment, government benefits, or housing; or for any other purpose authorized under the FCRA. By accessing one of our services, you agree not to use the service or data for any purpose authorized under the FCRA or in relation to taking an adverse action relating to a consumer application.